Exploring Cap Tables: A Guide for Private Company Investors

In the realm of private company investments, knowledge is power. Unlike the public markets, where information flows freely, the private secondary market presents investors with a unique challenge: the scarcity of readily available financial and business metrics. In navigating this landscape, one indispensable tool emerges as a beacon of insight: the capitalization table, commonly known as the “cap table.” At Oggi Equity, we recognize the pivotal role of cap tables in empowering investors to make informed decisions. This guide will delve into the intricacies of cap tables and unravel their significance in evaluating private company investments.

Download Now: Pre IPO Checklist

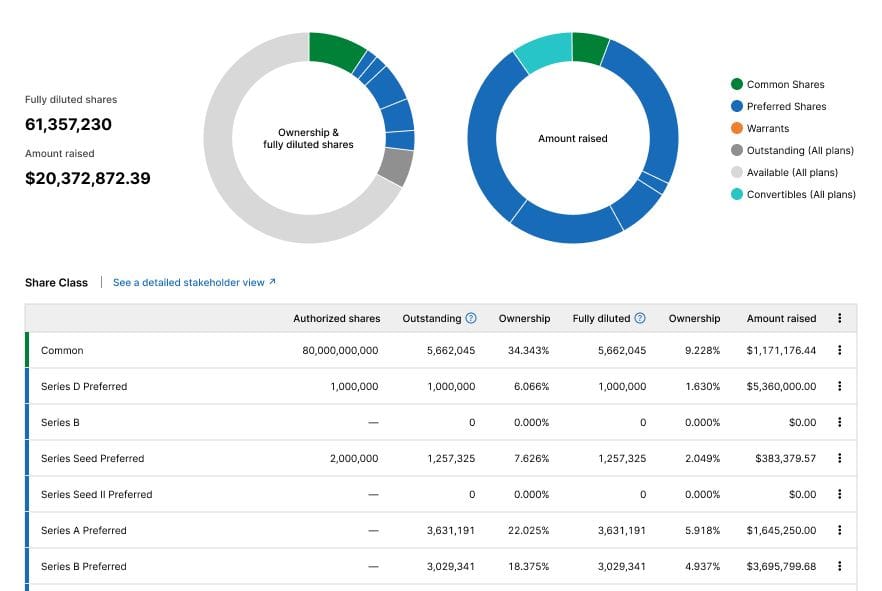

Here are the primary components typically found within a cap table:

1. Common Stock: This represents the foundational equity interest held by founders, employees, and early investors.

2. Preferred Stock: Venture capitalists and other early-stage investors often hold preferred stock, entailing certain privileges such as dividend preference or priority in liquidation proceedings. These provisions can profoundly impact shareholder returns during exit events.

3. Convertible Notes: Issued during the company’s nascent stages, convertible notes function as loans with the intent to convert into equity, usually common stock, during subsequent funding rounds.

4. Stock Options and Warrants: These equity compensation instruments are instrumental in attracting and retaining talent by offering the right to purchase shares at a predetermined price, typically converting into common stock upon exercise.

5. SAFEs and KISSes: Simplifying the early-stage financing process, these alternative instruments, including Simple Agreements for Future Equity and Keep It Simple Securities, offer streamlined investment mechanisms.

Why Understanding Cap Tables Matters

For investors, comprehending a company’s cap table is indispensable for several reasons:

- Ownership Clarity: Cap tables provide transparency regarding share ownership, enabling investors to ascertain the distribution and proportions of ownership interests.

- Valuation Assessment: By analyzing the cap table, investors can gauge the company’s valuation at its latest funding round, offering crucial insights into the potential value of their investment.

- Exit Strategy: Understanding the liquidity preferences of different share classes equips investors to navigate potential exit scenarios, be it through mergers, acquisitions, or initial public offerings (IPOs).

- Identifying Red Flags: Vigilance is key in detecting any anomalies or concerning structures within the cap table, such as disproportionate liquidation preferences, which could adversely impact returns.

Beyond the Cap Table: Considering Debt and Dilution

While cap tables furnish valuable insights, it’s essential to recognize their limitations. Debt, whether in the form of venture loans or traditional borrowing, often remains unaccounted for in cap tables. However, debt holds precedence over equity in terms of seniority, significantly influencing investment outcomes in scenarios of liquidation or financial distress. Investors must factor in debt obligations when evaluating potential returns from an investment.

Moreover, understanding dilution is paramount as companies undergo successive funding rounds, leading to the issuance of additional shares. Cap tables elucidate how dilution may affect existing shareholders, offering clarity on share count variations across funding rounds.

Navigating the Private Markets with Oggi Equity

At Oggi Equity, we’re committed to fostering transparency and accessibility in private market investing. Our dedication to providing comprehensive offering documents includes a meticulous breakdown of company cap tables, empowering investors with actionable insights.

While private companies may not offer the same level of reporting as their public counterparts, cap tables furnish a window into their worth, ownership structure, and critical liquidity preferences. As the allure of the private markets grows, driven by the potential for asymmetric returns and diversification, understanding cap tables emerges as a linchpin for informed investment decisions.

In conclusion, armed with a nuanced understanding of cap tables, investors can navigate the intricacies of the private markets with confidence, leveraging insights to seize lucrative investment opportunities. Join us at Oggi Equity as we embark on a journey to unlock the vast potential of private company investments.